My content is reader-supported by awesome people like you. Which means I could earn a commission. Learn more here!

Shopify is a HUGE all in one eCommerce platform providing the ecosystem for everything needed for your eCommerce business.

Even:

Short term funding

OK

Maybe you knew that because you found this article while searching for that.

Regardless

Let’s check out Shopify capital and see what it’s all about.

What is Shopify Capital?

This is a business finance program directly through Shopify to get access quickly to funds needed to grow your business.

Shopify Capital Reviews for The Pros And Cons

This is a great solution to provide some finance for your business.

But, let’s check out some key pros and cons to help way this out.

Pros of Shopify Capital

- Easy funding process

- Nice range of funding amounts

- Less expensive than other short-term loan options or cash advances

- Easy to monitor the payment process from your Shopify dashboard

- Once approved delivered directly to your business bank account

- Pay just a percentage of your earnings

The Cons Of Shopify Capital

- Up to 5 business days for a decision

- Limited to Shopify users

- The criteria to get approved are not fully clear

- Shopify initiates the process

- No long-term financing

Who Can Apply for Shopify Capital Support?

If you’re interested in applying for this you will want to make sure you’re eligible to do VIA their terms and conditions.

Shopify doesn’t just have a loan application for this.

They will contact you if you are eligible for this

But:

Another thing to know is you will see an offer on the homepage of your Shopify admin panel with an invite.

A few things Shopify bases its funding on:

- How many sales are you doing?

- Are you using Shopify payments or a third-party provider

- Is your business risky?

- Where you are located such as (the United States, Australia, or Canada)

- A key technique called quantile regression (Prediction of future sales)

So be on the lookout for a message from them too because you will only have 30 days to accept it.

How Do I Keep Track Of Your Loan Repayments

After you are approved and funded you’re able to keep track of your balance of what’s owned right under the capital page in the Shopify admin panel.

You will be able to view:

- Remaining balance owed

- Amount of total owed that has been repaid

- Transfer history

Under the transfer history section, you will be able to see each day’s sales and how much was sent to pay your Shopify capital loan.

Services Offered By Shopify Capital

There are a couple of routes you can go when getting short-term funding.

Merchant cash advance or a short-term loan.

Let’s look at each one.

Merchant cash advance – this is where you get a lump sum that you receive from Shopify Capital in return for a fixed borrowing cost. Then, a percentage of your daily sales is repaid to Shopify Capital until you repay the full amount.

Short-term loan – in this route you get a lump sum and agree on a fixed flat fee over a set period of time.

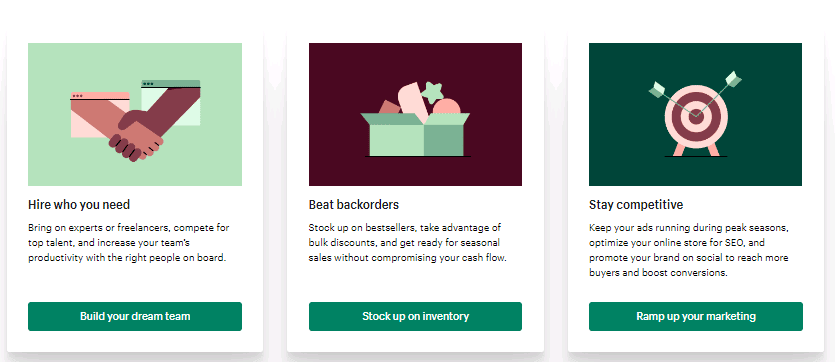

When should I consider Shopify capital for my business?

Being able to run your business with just cash is the key.

But things come up and as well certain situations come up where this could really come in handy.

Let’s look at a few.

Seasonal Gaps – Maybe your volume peaks in seasons because of the type of products you sell. This will help bridge the seasonal gap.

Unanticipated downturns – many things can be thrown at you such as supply chain issues, recession, depression, inflation, etc.

Business growth – you could run into rapid growth, huge spikes, increased demand, etc. Just tough to say but you can depend on this to help you meet your need.

Regardless this is just another way you can prepare and plan for your business’s current needs and future needs.

Customer Support

Customer service for Shopify Capital is available 24/7 VIA live chat, email or phone.

From what I can tell many users seem to be happy in regards to the service Shopify is offering for their Shopify Capital program.

I personally feel they offer terrific service.

I’ve had some times when they didn’t have the answer to some of the questions I asked and had to follow up.

FAQ on Shopify Capital

How do I get approved for Shopify Capital?

Shopify will reach out to you if you qualify. There isn't an application process

What is Remittance

Money that is delivered to apply against the total to remit.

How long do you have to pay off Shopify Capital

You have 12 months to pay this loan off.

How long does it to get a decision with Shopify Capital?

Shopify Capital will notify you in 2-5 business days on their decision.

Can I get another Shopify Capital loan after paying off my first loan?

I was researched this and couldn’t get full clarification on this. I’m going to assume though the same criteria will be used to possibly offer you a Shopify Capital loan again.

My Final Thoughts On Shopify Capital

I definitely feel Shopify capital is something to consider.

I would not fully depend on this at all times because your goal is to grow your business and utilize your profits to reinvest.

Overall though:

I feel the products are fair and very helpful at certain times.

I’d love to hear your thoughts or comments about Shopify Capital in the comments below.

Or contact me if you have any questions too.

Leave a Reply